How to Effectively Calculate Interest on Student Loan: A Comprehensive Guide for Borrowers

#### Introduction to Student LoansStudent loans are a significant financial commitment for many individuals pursuing higher education. Understanding how to……

#### Introduction to Student Loans

Student loans are a significant financial commitment for many individuals pursuing higher education. Understanding how to manage these loans, particularly how to calculate interest on student loan, is crucial for effective financial planning.

#### Understanding Student Loan Interest

When you take out a student loan, you are essentially borrowing money that you will need to pay back with interest. Interest is the cost of borrowing money, and it can significantly impact the total amount you will repay over the life of the loan.

#### Types of Student Loans

There are two primary types of student loans: federal and private. Federal student loans typically have fixed interest rates set by the government, while private loans may have variable rates that can fluctuate over time. Understanding the type of loan you have is essential for accurately calculating interest.

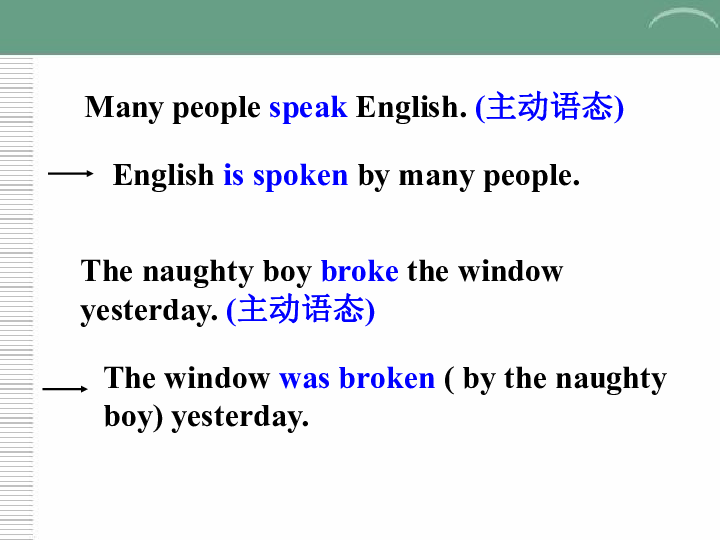

#### How to Calculate Interest on Student Loan

To calculate interest on student loans, you'll need to know the principal amount (the original amount borrowed), the interest rate, and the loan term (the duration over which you will repay the loan). The formula for calculating simple interest is:

Interest = Principal x Rate x Time

For example, if you have a student loan of $10,000 with an interest rate of 5% and a loan term of 10 years, the interest would be calculated as follows:

Interest = $10,000 x 0.05 x 10 = $5,000

This means that over the course of 10 years, you will pay $5,000 in interest, making your total repayment amount $15,000.

#### Understanding Compounding Interest

Most student loans use compound interest, which means that interest is calculated on the initial principal and also on the accumulated interest from previous periods. This can lead to a higher total repayment amount.

For example, if your loan compounds annually, you would calculate the interest for the first year and add it to the principal for the second year’s calculation. This compounding effect can significantly increase the total interest paid over the life of the loan.

#### Tools for Calculating Student Loan Interest

There are various online calculators available that can help you calculate interest on student loans. These tools allow you to input your loan amount, interest rate, and loan term to get an estimate of your total repayment amount and interest paid.

Additionally, many financial institutions provide resources and calculators on their websites to assist borrowers in understanding their loans better.

#### Strategies to Manage Student Loan Interest

1. **Make Payments While in School**: If possible, start making interest payments while you are still in school. This can prevent interest from accumulating and compounding.

2. **Consider Loan Forgiveness Programs**: Research if you qualify for any loan forgiveness programs that can reduce your overall loan burden.

3. **Refinance Your Loans**: If you have good credit and a stable income, refinancing your loans can potentially lower your interest rate and reduce your total repayment amount.

4. **Stay Informed**: Keep track of your loans, interest rates, and repayment options. Being proactive can help you make informed decisions about your student loans.

#### Conclusion

Calculating interest on student loans is a vital part of managing your educational finances. By understanding how interest works and utilizing tools and strategies to manage it, you can minimize the financial burden of your student loans and set yourself up for a more secure financial future. Always remember to review your loan agreements and stay informed about your repayment options to make the best financial decisions.