Understanding FHA Loan Limits in Utah: What You Need to Know

Guide or Summary:What Are FHA Loan Limits?Why FHA Loans Are Popular in UtahHow to Apply for an FHA Loan in UtahFinal Thoughts on FHA Loan Limits in UtahWhen……

Guide or Summary:

- What Are FHA Loan Limits?

- Why FHA Loans Are Popular in Utah

- How to Apply for an FHA Loan in Utah

- Final Thoughts on FHA Loan Limits in Utah

When considering home financing options in Utah, it's crucial to understand the FHA loan limits Utah has set for 2023. The Federal Housing Administration (FHA) provides insurance on loans made by approved lenders to borrowers with low to moderate incomes. One of the key aspects of FHA loans is the limits on the amount you can borrow, which can vary significantly based on the area you are looking to buy in.

What Are FHA Loan Limits?

FHA loan limits are the maximum amounts that the FHA will insure for a mortgage. These limits are determined by the county in which the property is located and are influenced by the median home prices in that area. The limits are updated annually to reflect changes in the housing market. In Utah, the FHA loan limits Utah residents need to be aware of can differ between urban and rural areas, with metropolitan areas generally having higher limits due to increased housing costs.

For 2023, the FHA loan limits in Utah range from approximately $472,030 for a single-family home in less populated counties to over $1 million in high-cost areas like Salt Lake County. This range allows a variety of buyers, including first-time homeowners and those looking to upgrade, to access affordable financing options.

Why FHA Loans Are Popular in Utah

FHA loans are particularly attractive to first-time homebuyers because they require a lower down payment compared to conventional loans. Borrowers can put down as little as 3.5% of the purchase price, making homeownership more accessible. Additionally, FHA loans have more lenient credit score requirements, which can be beneficial for those with less-than-perfect credit histories.

In Utah, where the housing market can be competitive, understanding the FHA loan limits Utah offers can help buyers make informed decisions. Knowing the maximum loan amounts can guide potential homeowners in their property search and financial planning.

How to Apply for an FHA Loan in Utah

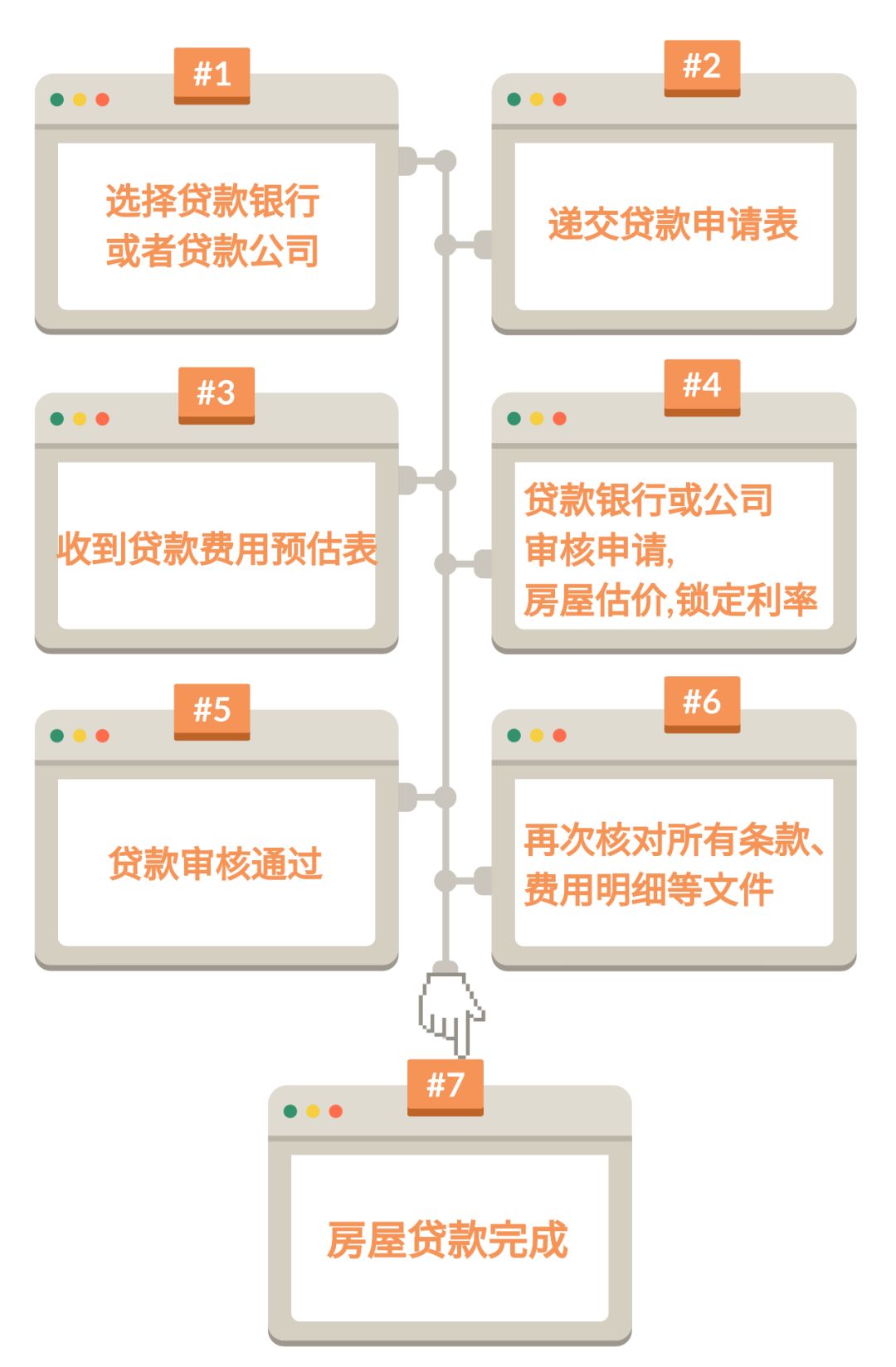

Applying for an FHA loan in Utah involves several steps. First, potential borrowers should check their credit scores and gather necessary documentation, such as income statements and tax returns. Next, it's important to find a lender who is approved by the FHA. Many local banks and mortgage companies in Utah offer FHA loans, so it's advisable to shop around for the best rates and terms.

Once you've chosen a lender, you will need to complete the loan application and provide the required documentation. The lender will review your financial situation and determine your eligibility based on the FHA loan limits Utah has set. After approval, the lender will provide a loan estimate, detailing the terms, costs, and monthly payments associated with the loan.

Final Thoughts on FHA Loan Limits in Utah

Understanding the FHA loan limits Utah offers is essential for anyone looking to purchase a home in the state. These limits can significantly impact your home buying journey, from the types of properties you can consider to the financing options available. By staying informed and working with knowledgeable lenders, you can navigate the home buying process more effectively and secure the financing you need to achieve your homeownership goals.

In conclusion, FHA loans present a viable option for many Utah residents, especially first-time buyers. With the right information and resources, you can leverage the benefits of FHA financing to make your dream of homeownership a reality.