A Comprehensive Guide on How to Report PPP Loan on Tax Return: Essential Steps and Tips

Guide or Summary:Understanding the PPP LoanTax Implications of PPP LoansSteps to Report PPP Loan on Your Tax ReturnCommon Mistakes to Avoid**Translation of……

Guide or Summary:

- Understanding the PPP Loan

- Tax Implications of PPP Loans

- Steps to Report PPP Loan on Your Tax Return

- Common Mistakes to Avoid

**Translation of "how to report ppp loan on tax return":** how to report ppp loan on tax return

---

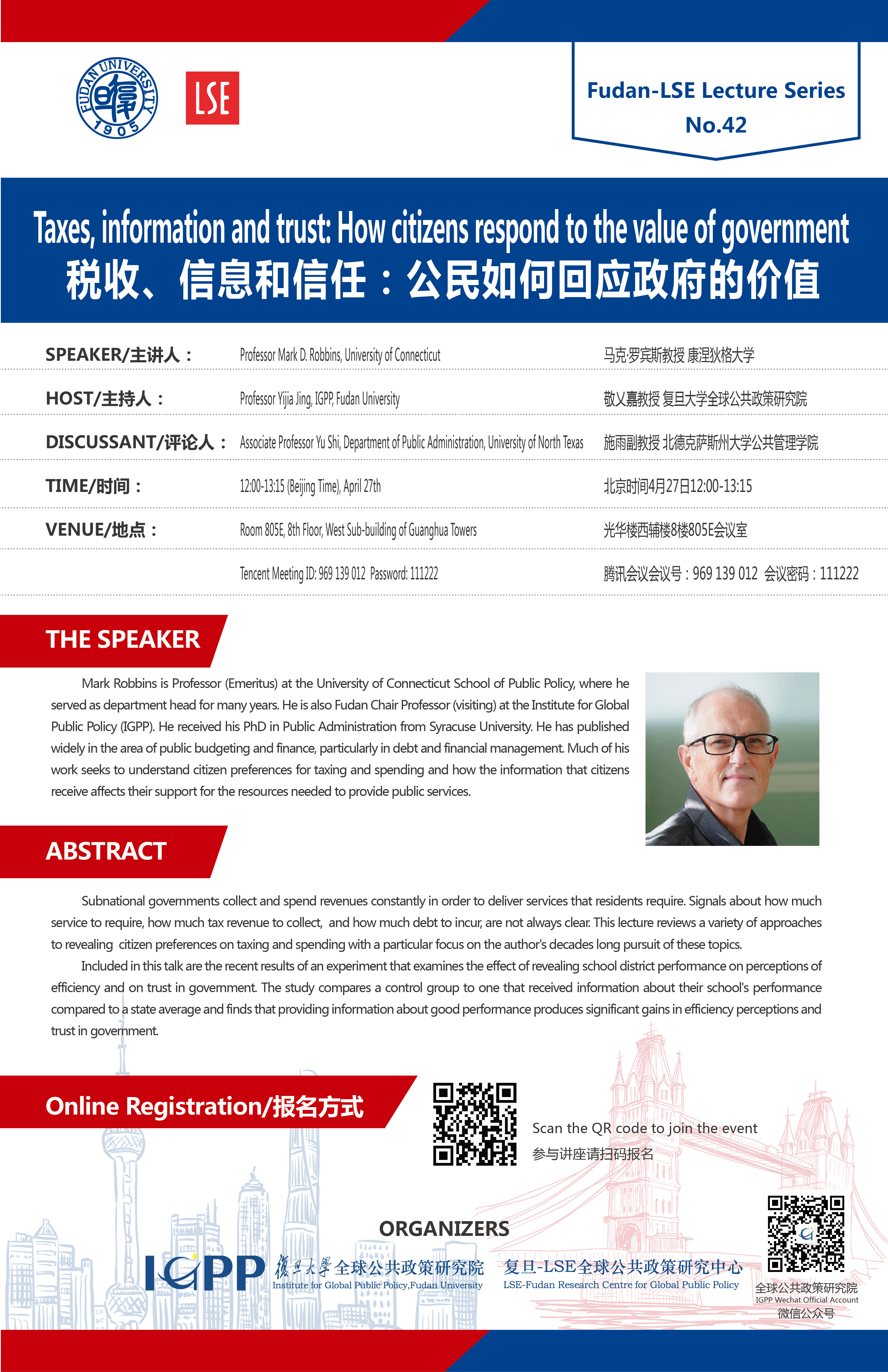

Understanding the PPP Loan

The Paycheck Protection Program (PPP) was introduced as part of the CARES Act to provide financial assistance to small businesses affected by the COVID-19 pandemic. These loans are designed to help businesses keep their workforce employed during the crisis. However, understanding how to report PPP loans on your tax return can be complex, especially when it comes to forgiveness and tax implications.

Tax Implications of PPP Loans

When you receive a PPP loan, it’s crucial to know that the funds used for eligible expenses, such as payroll, rent, and utilities, may be forgiven. However, the IRS has issued guidelines that state that the expenses paid with the forgiven loan amount cannot be deducted from your taxable income. This means that while the loan itself is not taxable, the expenses associated with it may not provide the usual tax benefits.

Steps to Report PPP Loan on Your Tax Return

1. **Gather Documentation**: Before you start filling out your tax return, ensure you have all relevant documentation. This includes your PPP loan agreement, bank statements showing the loan deposit, and records of how the funds were used.

2. **Determine Loan Forgiveness**: If you have applied for and received forgiveness for your PPP loan, you will need to report this on your tax return. The forgiveness amount is not considered taxable income, but you must accurately reflect the expenses for which the loan was used.

3. **Complete Your Tax Forms**: When it comes to reporting the PPP loan on your tax return, you will typically use Form 1040 for individual income tax returns or Form 1065 for partnerships. If you are a corporation, you will use Form 1120. Ensure that you include any forgiven amounts and reflect the non-deductibility of the expenses.

4. **Consult with a Tax Professional**: Given the complexities of tax laws and the implications of the PPP loan, it may be wise to consult with a tax professional. They can provide personalized advice based on your specific situation and help ensure that you comply with all IRS regulations.

Common Mistakes to Avoid

Many taxpayers make mistakes when reporting PPP loans on their tax returns. Here are some common pitfalls to avoid:

- **Failing to Keep Accurate Records**: Documentation is key when it comes to justifying your use of PPP funds. Ensure you have a clear record of how the funds were spent to avoid issues with the IRS.

- **Misreporting Forgiveness Amounts**: Be careful when reporting the amount of your PPP loan that was forgiven. Misreporting can lead to complications or audits.

- **Ignoring Changes in Tax Laws**: Tax laws can change, and it’s essential to stay updated on any new regulations regarding PPP loans and their reporting.

Navigating the process of how to report PPP loan on tax return can be challenging, but understanding the implications and following the correct steps can make it easier. Always keep thorough documentation, be aware of the tax implications, and don’t hesitate to seek professional advice if needed. By taking these steps, you can ensure that you comply with tax regulations while maximizing your financial benefits from the PPP loan program.