Understanding Jumbo Loan Amounts: What You Need to Know About High-Value Mortgages

Guide or Summary:What is a Jumbo Loan Amount?Why Choose a Jumbo Loan Amount?Eligibility Requirements for Jumbo Loan AmountsInterest Rates and Terms for Jumb……

Guide or Summary:

- What is a Jumbo Loan Amount?

- Why Choose a Jumbo Loan Amount?

- Eligibility Requirements for Jumbo Loan Amounts

- Interest Rates and Terms for Jumbo Loan Amounts

- Benefits of Jumbo Loan Amounts

- Challenges of Jumbo Loan Amounts

What is a Jumbo Loan Amount?

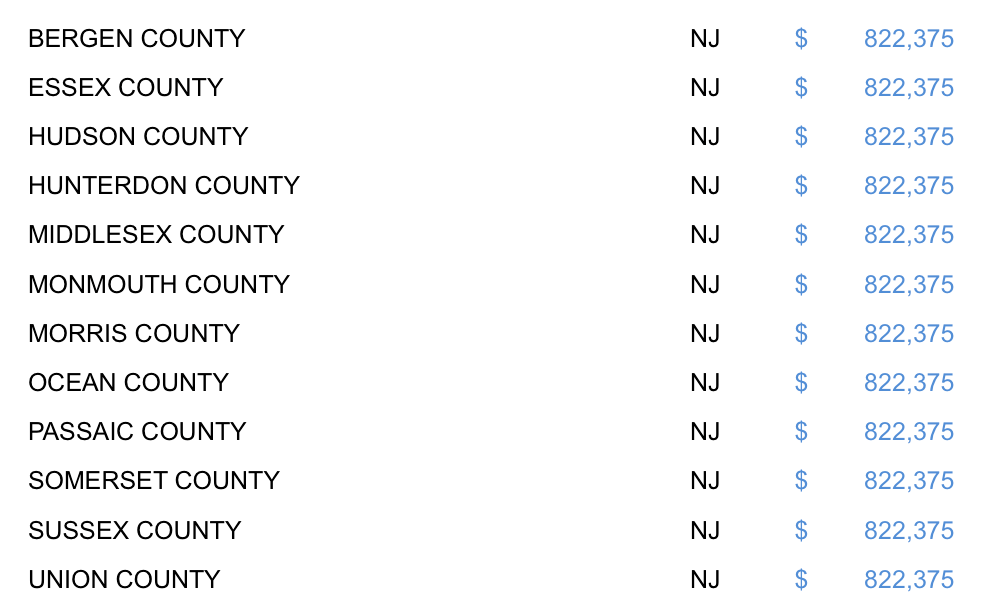

A **jumbo loan amount** refers to a type of mortgage that exceeds the conforming loan limits set by the Federal Housing Finance Agency (FHFA). In 2023, the conforming loan limit for a single-family home in most areas of the United States is $726,200, but in high-cost areas, this limit can be significantly higher. A **jumbo loan** is designed for borrowers who are looking to finance high-value properties that fall outside these limits. Because they are not backed by Fannie Mae or Freddie Mac, jumbo loans typically come with stricter credit requirements and higher interest rates.

Why Choose a Jumbo Loan Amount?

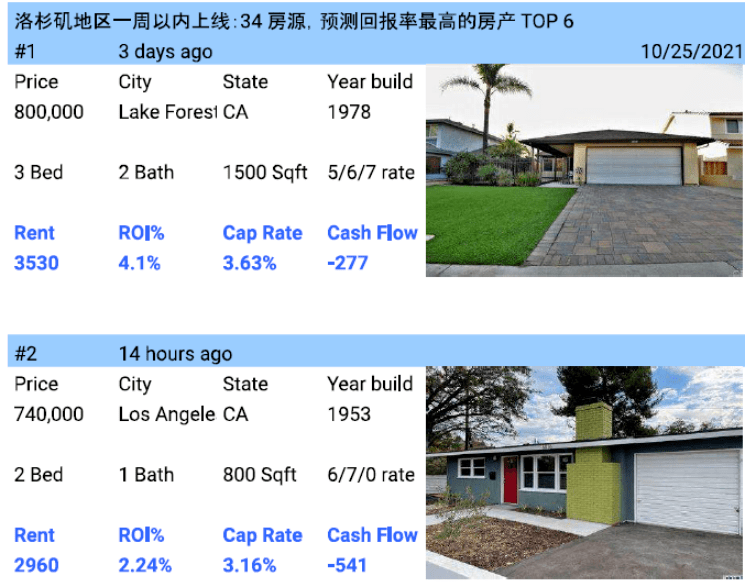

There are several reasons why a borrower might opt for a **jumbo loan amount**. First and foremost, it allows individuals to purchase luxury homes or properties in high-demand areas where real estate prices are soaring. For many, a conventional loan simply won't cover the cost of their desired property, making a jumbo loan the only viable option. Additionally, jumbo loans can be used for refinancing existing mortgages, enabling homeowners to tap into their home equity or secure better terms.

Eligibility Requirements for Jumbo Loan Amounts

To qualify for a **jumbo loan amount**, borrowers typically need to meet stringent eligibility criteria. Lenders often require a higher credit score—usually above 700—along with a lower debt-to-income ratio. This means that your monthly debt payments should not exceed a certain percentage of your monthly income. Additionally, borrowers may need to provide a larger down payment, often 20% or more, to demonstrate financial stability and lower the lender's risk.

Interest Rates and Terms for Jumbo Loan Amounts

Interest rates for **jumbo loan amounts** tend to be higher than those for conforming loans. This is primarily due to the increased risk lenders face when offering these larger sums. However, the gap between jumbo and conforming loan rates has narrowed in recent years, making them more accessible for qualified borrowers. Terms for jumbo loans can vary, with options typically ranging from 15 to 30 years, allowing borrowers to choose a plan that best fits their financial situation.

Benefits of Jumbo Loan Amounts

One of the key benefits of a **jumbo loan amount** is the flexibility it offers. Borrowers can secure financing for properties that are otherwise unattainable with standard loans. Additionally, jumbo loans can provide an avenue for investment in high-value real estate, potentially leading to significant returns. Furthermore, many lenders offer various loan structures, such as fixed-rate and adjustable-rate options, allowing borrowers to customize their mortgage according to their financial strategy.

Challenges of Jumbo Loan Amounts

Despite their advantages, **jumbo loan amounts** come with challenges. The stricter credit requirements and higher interest rates can be barriers for some borrowers. Additionally, the appraisal process for jumbo loans can be more rigorous, as lenders want to ensure that the property is worth the investment. Borrowers should also be aware of the potential for higher closing costs, which can add to the overall expense of securing a jumbo loan.

In summary, a **jumbo loan amount** is an essential tool for those looking to finance high-value properties that exceed conventional loan limits. Understanding the eligibility requirements, interest rates, and benefits associated with jumbo loans can help borrowers make informed decisions. While they offer unique advantages, it is crucial to consider the challenges and ensure that a jumbo loan aligns with your financial goals. Whether you are purchasing your dream home or investing in real estate, knowing about jumbo loan amounts can empower you to navigate the mortgage landscape effectively.