Unlock Your Future with the William D. Ford Federal Direct Loan Program

Guide or Summary:What is the William D. Ford Federal Direct Loan?Benefits of the William D. Ford Federal Direct LoanEligibility for the William D. Ford Fede……

Guide or Summary:

- What is the William D. Ford Federal Direct Loan?

- Benefits of the William D. Ford Federal Direct Loan

- Eligibility for the William D. Ford Federal Direct Loan

- How to Apply for the William D. Ford Federal Direct Loan

Are you considering furthering your education but feeling overwhelmed by the financial burden? The William D. Ford Federal Direct Loan program might be the solution you’ve been searching for. This federal initiative is designed to provide students with the necessary financial resources to achieve their academic goals without the excessive stress of high-interest rates and rigid repayment plans. In this comprehensive guide, we will explore the ins and outs of the William D. Ford Federal Direct Loan, its benefits, eligibility requirements, and how to apply, ensuring you have all the information you need to make an informed decision.

What is the William D. Ford Federal Direct Loan?

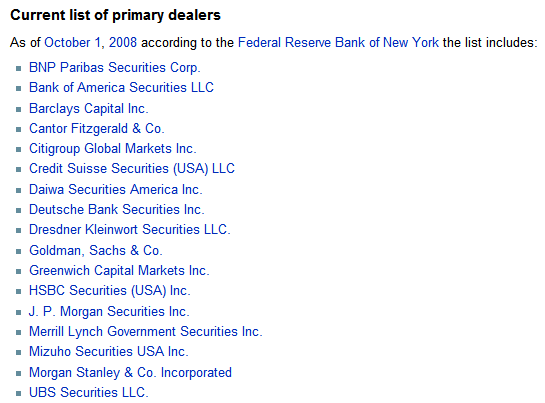

The William D. Ford Federal Direct Loan program, often referred to as Direct Loans, is a federal student loan program that allows students to borrow directly from the U.S. Department of Education. This program offers several types of loans, including Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans for graduate students and parents, and Direct Consolidation Loans. Each type of loan is tailored to meet different financial needs, making it a versatile option for students at various stages of their educational journey.

Benefits of the William D. Ford Federal Direct Loan

One of the most significant advantages of the William D. Ford Federal Direct Loan program is its relatively low-interest rates compared to private loans. This can save you thousands of dollars over the life of the loan. Additionally, federal loans offer flexible repayment options, including income-driven repayment plans that adjust your monthly payments based on your income and family size.

Moreover, Direct Loans come with various borrower protections, such as deferment and forbearance options, which can provide temporary relief if you face financial difficulties after graduation. For those who pursue public service careers, the Public Service Loan Forgiveness (PSLF) program can forgive the remaining balance on your Direct Loans after you make 120 qualifying monthly payments while working for a qualifying employer.

Eligibility for the William D. Ford Federal Direct Loan

To qualify for the William D. Ford Federal Direct Loan program, you must meet several criteria. First, you need to be a U.S. citizen or an eligible non-citizen and have a valid Social Security number. Additionally, you must be enrolled at least half-time in an eligible degree or certificate program at a participating institution.

It’s also essential to complete the Free Application for Federal Student Aid (FAFSA) to determine your financial need and eligibility for federal student aid. The FAFSA will assess your financial situation and help identify the types of loans and grants for which you may qualify.

How to Apply for the William D. Ford Federal Direct Loan

Applying for the William D. Ford Federal Direct Loan is a straightforward process. Start by completing the FAFSA, which is available online. Once your FAFSA is processed, your school will receive your information and determine your eligibility for federal student loans.

The financial aid office at your institution will provide you with a financial aid package that outlines the types of loans you are eligible for, including the William D. Ford Federal Direct Loan. If you accept the loan offer, you will need to complete entrance counseling to understand your responsibilities as a borrower and sign a Master Promissory Note (MPN), which is your agreement to repay the loan.

Investing in your education is one of the most significant decisions you will make, and the William D. Ford Federal Direct Loan program is here to support you every step of the way. With its low-interest rates, flexible repayment options, and borrower protections, this program can help you achieve your academic dreams without the weight of overwhelming debt. Don’t let financial barriers hold you back—explore the possibilities with the William D. Ford Federal Direct Loan and take the first step towards a brighter future today!