Discover the Best NRI Housing Loan Interest Rates for Your Dream Home Investment

Guide or Summary:NRI Housing Loan Interest RatesUnderstanding NRI Housing LoansFactors Influencing NRI Housing Loan Interest RatesCurrent Trends in NRI Hous……

Guide or Summary:

- NRI Housing Loan Interest Rates

- Understanding NRI Housing Loans

- Factors Influencing NRI Housing Loan Interest Rates

- Current Trends in NRI Housing Loan Interest Rates

- Benefits of Securing the Right NRI Housing Loan Interest Rates

NRI Housing Loan Interest Rates

Are you an NRI (Non-Resident Indian) looking to invest in your dream home back in India? One of the most critical factors to consider when planning your property investment is the NRI housing loan interest rates. Understanding these rates can help you make informed decisions and maximize your investment potential.

The Indian real estate market has been witnessing a surge in demand, and NRIs are increasingly tapping into this opportunity. However, before you embark on this exciting journey, it's essential to grasp the nuances of housing loans available to NRIs and how the interest rates can impact your overall financial strategy.

Understanding NRI Housing Loans

NRI housing loans are specifically designed for Indians living abroad who wish to purchase property in India. These loans come with various features, including flexible repayment options, competitive interest rates, and the ability to finance both residential and commercial properties.

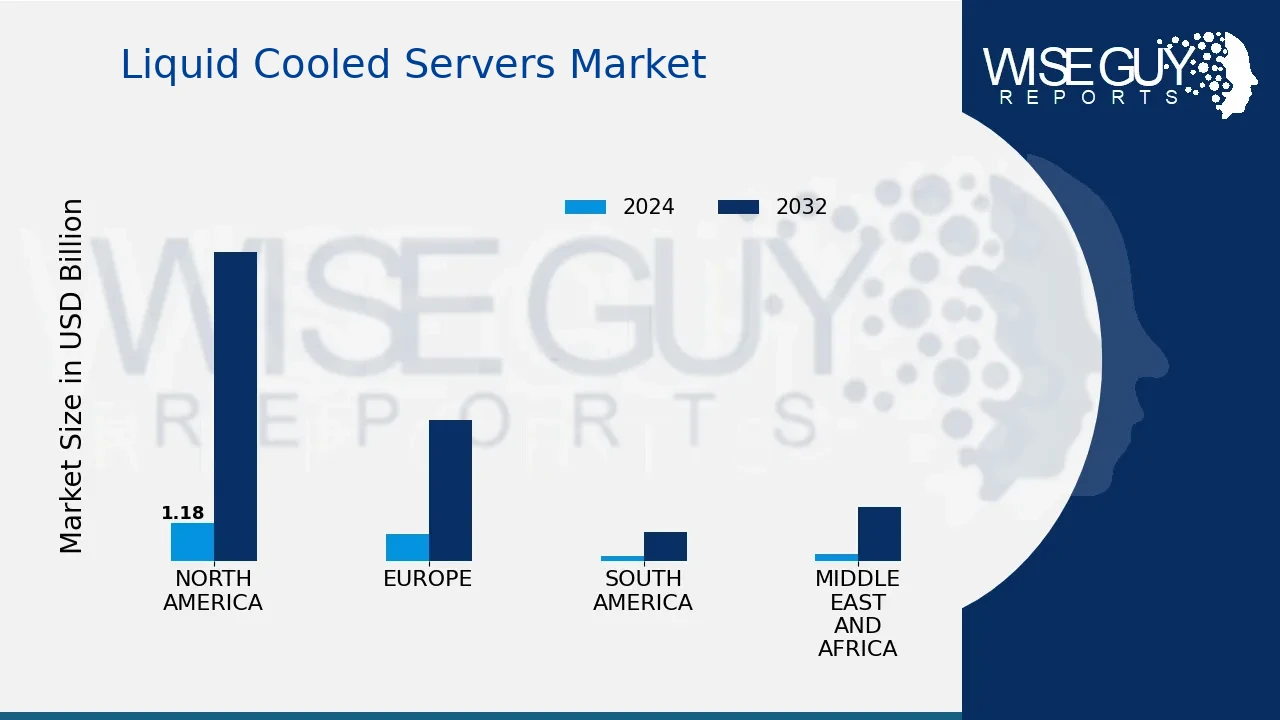

When considering an NRI housing loan, the NRI housing loan interest rates play a pivotal role. These rates can vary significantly among different banks and financial institutions, and they are influenced by various factors, including the Reserve Bank of India's monetary policy, the lender's internal policies, and the borrower's creditworthiness.

Factors Influencing NRI Housing Loan Interest Rates

1. **Credit Score**: Your credit score is a crucial determinant of the interest rate you may receive. A higher credit score typically translates to lower interest rates, while a lower score can lead to higher rates.

2. **Loan Amount**: The amount you wish to borrow can also influence the interest rate. Generally, larger loan amounts may attract lower interest rates.

3. **Loan Tenure**: The duration of the loan repayment period can affect the interest rate. Shorter tenures often come with lower rates, while longer tenures may have higher rates due to the increased risk for lenders.

4. **LTV Ratio (Loan-to-Value Ratio)**: This ratio indicates the amount of loan you are taking relative to the value of the property. A lower LTV ratio can lead to better interest rates.

5. **Type of Interest Rate**: NRI housing loans can come with fixed or floating interest rates. Fixed rates remain constant throughout the loan tenure, while floating rates can fluctuate based on market conditions.

Current Trends in NRI Housing Loan Interest Rates

As of now, many banks and financial institutions are offering attractive NRI housing loan interest rates to encourage property investments. These rates can range from 7% to 9% or even lower, depending on the lender and the borrower's profile.

Moreover, some lenders provide special offers and discounts during festive seasons or promotional periods, making it an excellent time for NRIs to secure favorable rates. It's advisable to compare rates from multiple lenders and consider the overall cost of borrowing, including processing fees and other charges.

Benefits of Securing the Right NRI Housing Loan Interest Rates

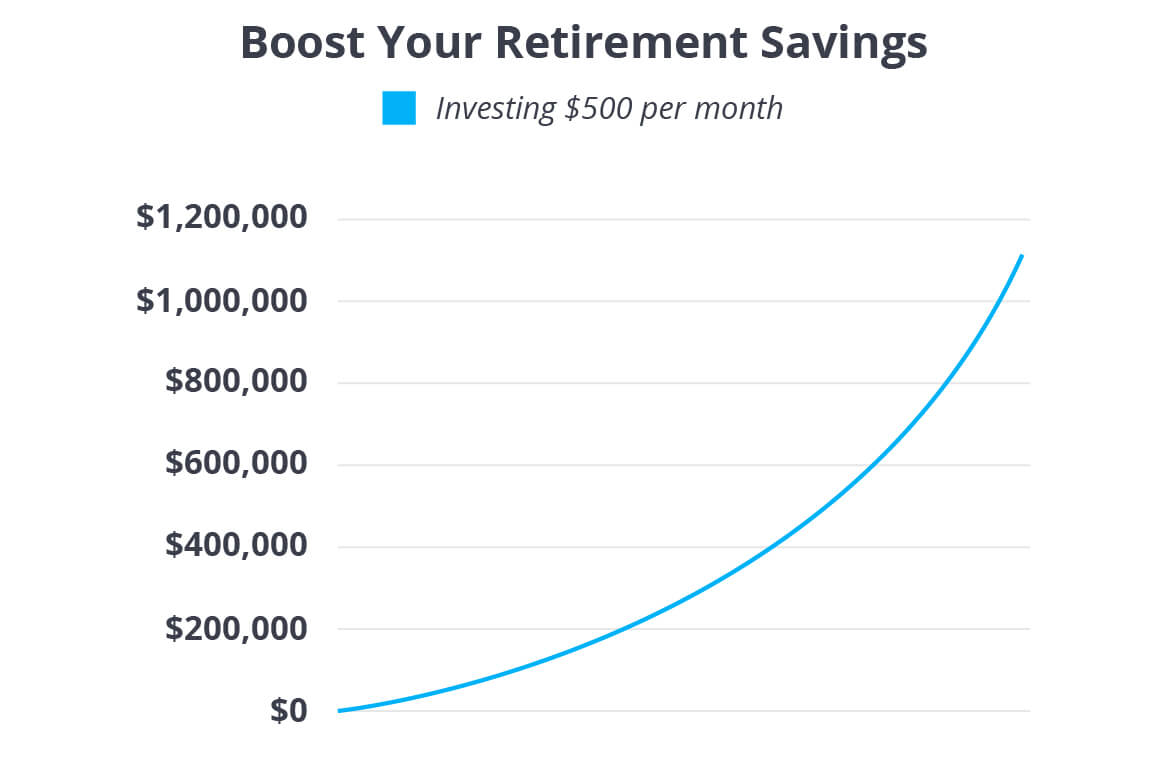

Securing the right NRI housing loan interest rates can lead to substantial savings over the loan tenure. A lower interest rate means reduced monthly EMI (Equated Monthly Installments), allowing you to allocate your finances more efficiently. Furthermore, with the right loan, you can invest in a property that meets your needs and aspirations, whether it’s a vacation home or a long-term investment.

In conclusion, understanding NRI housing loan interest rates is crucial for making informed decisions regarding your property investment in India. By considering various factors and staying updated on current trends, you can secure the best rates and make your dream of owning a home in India a reality. Start your journey today and explore the exciting opportunities that await you in the Indian real estate market!