Unlocking Homeownership: The Ultimate Guide to Co Borrower Home Loans

#### Description:In today’s competitive real estate market, many potential homeowners are discovering the advantages of a **co borrower home loan**. This fi……

#### Description:

In today’s competitive real estate market, many potential homeowners are discovering the advantages of a **co borrower home loan**. This financial option allows individuals to partner with a co-borrower to secure a mortgage, making homeownership more accessible than ever. Whether you’re a first-time buyer or looking to upgrade your living situation, understanding the ins and outs of **co borrower home loans** can be a game-changer.

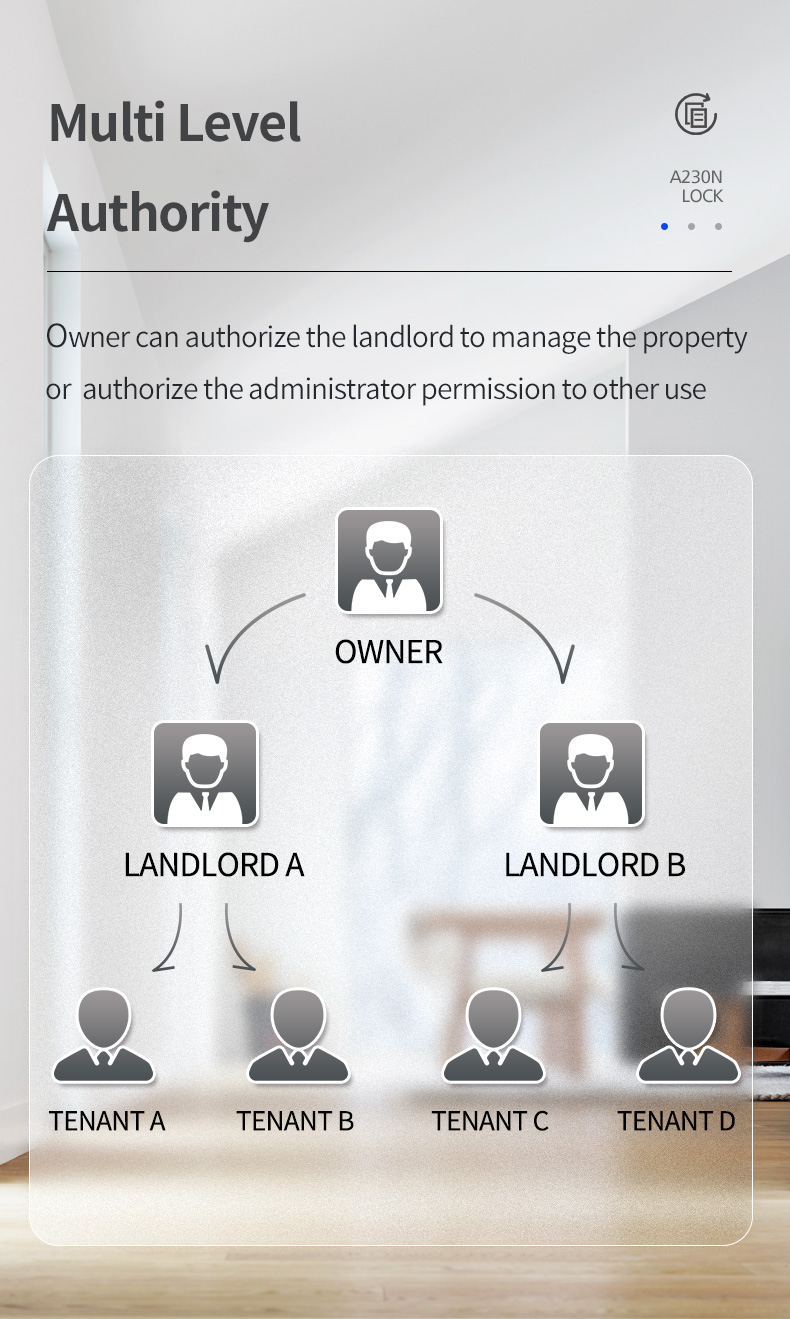

A **co borrower home loan** is a mortgage that involves two or more individuals who apply together. This arrangement can significantly enhance your borrowing power, as lenders consider the combined income and creditworthiness of all applicants. If you're struggling to qualify for a mortgage on your own due to insufficient income or a less-than-perfect credit score, having a co-borrower can provide the boost you need.

One of the primary benefits of a **co borrower home loan** is the increased likelihood of approval. Lenders are often more willing to extend credit when they see multiple sources of income, which can also lead to better interest rates. This means that by applying with a co-borrower, you may secure a more favorable loan term, ultimately saving you money over the life of the mortgage.

Moreover, a **co borrower home loan** can be an excellent option for couples, family members, or friends looking to invest in property together. This collaborative approach not only makes the financial burden lighter but also fosters a sense of shared responsibility. However, it’s crucial to choose a co-borrower wisely. Both parties will be equally responsible for the mortgage payments, and any missed payments can negatively impact both credit scores.

When considering a **co borrower home loan**, it’s essential to have open and honest discussions with your co-borrower about financial responsibilities and expectations. Create a plan that outlines how payments will be made, how expenses will be shared, and what will happen if one party can no longer contribute. Having this clarity upfront can prevent potential conflicts down the road.

Additionally, it’s important to understand the different types of **co borrower home loans** available. Options may include conventional loans, FHA loans, or VA loans, each with its unique requirements and benefits. Researching these options thoroughly can help you and your co-borrower make an informed decision that aligns with your financial goals.

As you navigate the process of obtaining a **co borrower home loan**, consider seeking the advice of a mortgage professional. They can guide you through the application process, help you understand the terms of your loan, and ensure that you are making the best financial decision for your situation.

In conclusion, a **co borrower home loan** can open doors to homeownership that may have previously seemed closed. By combining financial resources and responsibilities, you and your co-borrower can achieve your dream of owning a home. With careful planning and communication, this partnership can lead to a successful and rewarding home-buying experience. Don’t let financial hurdles hold you back—explore the possibilities of a **co borrower home loan** today and take the first step toward your new home!