Exploring GECU Home Equity Loan Rates: Unlocking Your Home’s Financial Potential

Guide or Summary:Understanding Home Equity LoansGECU Home Equity Loan Rates Compared to Other LendersBenefits of Choosing GECU for Your Home Equity LoanWhat……

Guide or Summary:

- Understanding Home Equity Loans

- GECU Home Equity Loan Rates Compared to Other Lenders

- Benefits of Choosing GECU for Your Home Equity Loan

- What to Consider Before Applying for a Home Equity Loan

**GECU Home Equity Loan Rates** (GECU房屋净值贷款利率)

When considering financing options, many homeowners overlook the potential of their home’s equity. One of the most effective ways to tap into this resource is through a home equity loan. Among the various lenders available, GECU offers competitive home equity loan rates that can help you achieve your financial goals. In this article, we will explore the benefits of GECU home equity loans, how their rates compare to other lenders, and what you need to know before applying.

Understanding Home Equity Loans

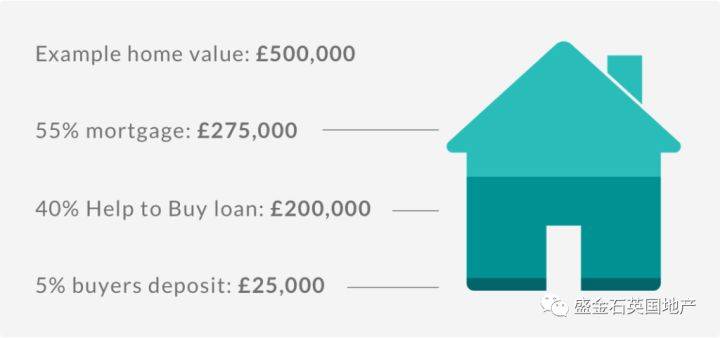

A home equity loan allows homeowners to borrow against the equity they have built up in their property. Equity is the difference between the current market value of your home and the outstanding balance on your mortgage. For example, if your home is worth $300,000 and you owe $200,000 on your mortgage, you have $100,000 in equity.

Using this equity can be a smart financial decision, especially when it comes to funding large expenses such as home renovations, paying off high-interest debt, or covering educational costs. GECU home equity loans provide a fixed interest rate, which means your monthly payments will remain consistent throughout the life of the loan, making budgeting easier.

GECU Home Equity Loan Rates Compared to Other Lenders

When looking for a home equity loan, one of the most critical factors to consider is the interest rate. GECU home equity loan rates are often competitive compared to other financial institutions. It’s essential to shop around and compare rates from various lenders, as even a small difference in interest rates can significantly impact the total amount you pay over the life of the loan.

GECU prides itself on offering transparent and straightforward loan options, which can be a significant advantage for borrowers. In addition to competitive rates, GECU provides excellent customer service and support, guiding you through the application process and helping you understand the terms of your loan.

Benefits of Choosing GECU for Your Home Equity Loan

1. **Competitive Rates**: GECU’s home equity loan rates are designed to be affordable, making it easier for homeowners to access the funds they need without breaking the bank.

2. **Flexible Loan Amounts**: Whether you need a small loan for minor repairs or a larger sum for significant renovations, GECU offers flexible loan amounts to meet your needs.

3. **Fixed Payments**: With a fixed-rate home equity loan, you can enjoy the peace of mind that comes with knowing exactly how much you’ll pay each month.

4. **Quick Approval Process**: GECU understands that time is of the essence when it comes to financing. Their streamlined application process ensures that you can access your funds quickly.

5. **Local Expertise**: As a local credit union, GECU has a deep understanding of the community and its residents. This local knowledge can be invaluable when it comes to tailoring loan options to fit your specific needs.

What to Consider Before Applying for a Home Equity Loan

Before committing to a home equity loan, it’s essential to evaluate your financial situation. Consider the following factors:

- **Your Credit Score**: A higher credit score can qualify you for better rates. Check your credit report and address any issues before applying.

- **Loan Purpose**: Clearly define what you intend to use the loan for, as this can affect the amount you borrow and the terms of the loan.

- **Repayment Ability**: Ensure that you can comfortably afford the monthly payments, taking into account any other financial obligations you may have.

- **Market Conditions**: Stay informed about current interest rates and market conditions, as these can influence your decision.

In conclusion, GECU home equity loan rates offer a valuable opportunity for homeowners to leverage their property’s equity for various financial needs. By understanding the benefits, comparing rates, and evaluating your financial situation, you can make an informed decision that aligns with your financial goals. Whether it’s funding a home improvement project or consolidating debt, a GECU home equity loan could be the key to unlocking your home’s financial potential.