Unlock Your PPP Loan Potential: A Comprehensive Guide with the PPP Loan Checker

Guide or Summary:PPP Loan CheckerPPP Loan CheckerAs small businesses navigate the complexities of financial aid during challenging economic times, the Paych……

Guide or Summary:

PPP Loan Checker

As small businesses navigate the complexities of financial aid during challenging economic times, the Paycheck Protection Program (PPP) has emerged as a crucial lifeline. Understanding how to leverage this program effectively can make a significant difference in maintaining payroll and covering essential expenses. One of the most valuable tools available to business owners is the PPP Loan Checker. This resource not only helps determine eligibility but also provides insights into the application process and forgiveness criteria.

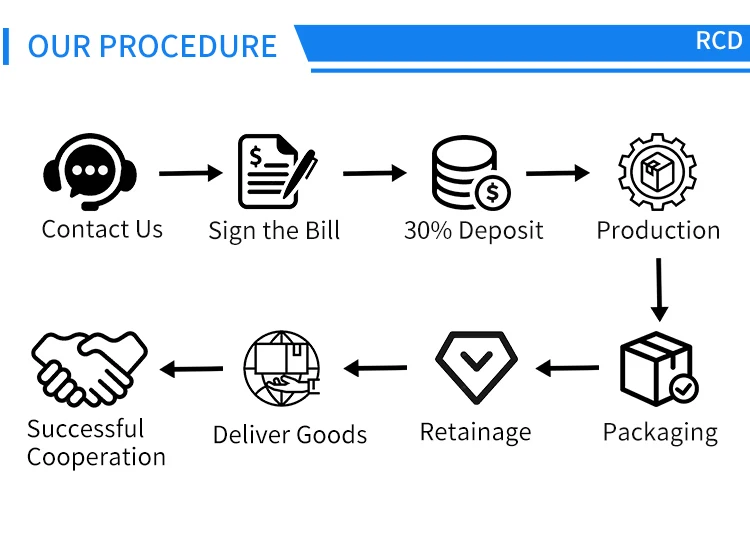

The PPP Loan Checker is an online tool designed to assist small business owners in evaluating their PPP loan status. It simplifies the process by allowing users to input their business information and quickly determine their eligibility for PPP loans. This is particularly beneficial for businesses that are unsure whether they qualify for funding or how much they can potentially receive. By utilizing the PPP Loan Checker, business owners can save time and avoid the frustration of navigating complex regulations and requirements.

One of the key features of the PPP Loan Checker is its ability to provide real-time updates on loan availability and changes in eligibility criteria. The PPP program has undergone various updates since its inception, and staying informed is crucial for business owners. The checker can help users understand the latest regulations, including any changes in loan amounts, interest rates, and forgiveness terms. This ensures that businesses can make informed decisions based on the most current information available.

In addition to eligibility checks, the PPP Loan Checker can also assist in calculating potential loan amounts. By inputting relevant data such as average monthly payroll, number of employees, and other qualifying expenses, users can receive an estimate of the funding they may be eligible for. This feature is particularly useful for businesses that are planning their budgets and need a clearer understanding of their financial position. Knowing the potential loan amount can help owners strategize on how to best use the funds to sustain their operations.

Another significant advantage of using the PPP Loan Checker is the guidance it offers on the forgiveness process. One of the most appealing aspects of the PPP is the possibility of loan forgiveness, which means that businesses can convert their loans into grants if they meet specific criteria. The checker provides information on what expenses qualify for forgiveness, such as payroll costs, rent, and utilities. It also outlines the necessary documentation required to apply for forgiveness, helping business owners prepare their applications accurately.

Moreover, the PPP Loan Checker serves as an educational resource. Many business owners may not fully understand the intricacies of the PPP program, including the various terms and conditions associated with the loans. The checker often includes links to helpful articles, FAQs, and other resources that can further clarify the program's details. This educational component empowers business owners to take control of their financial futures and make informed decisions about their funding options.

As the economic landscape continues to evolve, the importance of tools like the PPP Loan Checker cannot be overstated. Small businesses are the backbone of the economy, and ensuring they have access to the necessary resources is essential for recovery and growth. By utilizing the PPP Loan Checker, business owners can streamline the application process, maximize their funding potential, and navigate the complexities of the PPP program with confidence.

In conclusion, the PPP Loan Checker is an invaluable tool for small business owners seeking to leverage the Paycheck Protection Program effectively. By providing insights into eligibility, potential loan amounts, and forgiveness criteria, this checker empowers businesses to make informed decisions that can significantly impact their operations. As the economic environment continues to change, staying informed and utilizing available resources will be crucial for small businesses aiming to thrive in the post-pandemic world.