Bad Credit Loan Options: Find BBB Accredited Companies Near You

Guide or Summary:How to Find BBB Accredited Loan CompaniesWhat to Look for in a BBB Accredited Loan CompanyBenefits of Working with BBB Accredited Loan Comp……

Guide or Summary:

- How to Find BBB Accredited Loan Companies

- What to Look for in a BBB Accredited Loan Company

- Benefits of Working with BBB Accredited Loan Companies

With a less-than-stellar credit score, obtaining financing can feel like an insurmountable challenge. However, there are resources available to help you navigate this hurdle. BBB accredited loan companies for bad credit are a beacon of hope for those in financial distress. These lenders have a reputation for fairness and transparency, ensuring that you receive the financial assistance you need without being exploited.

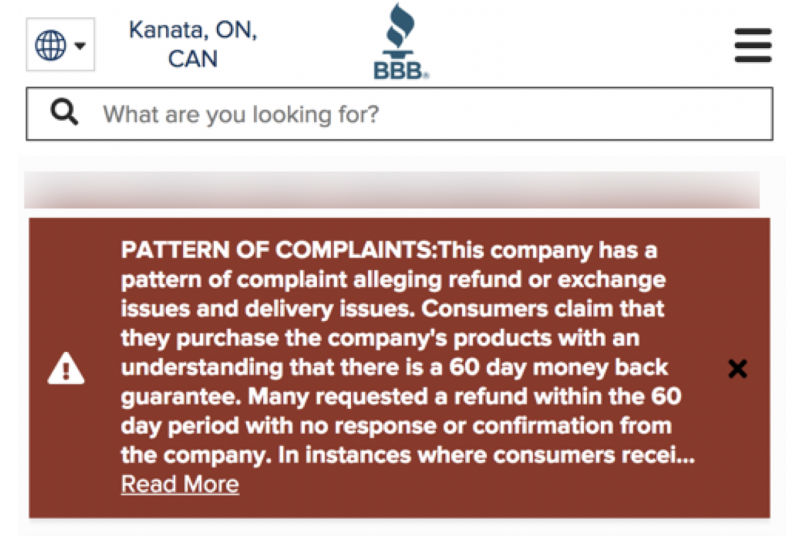

When searching for a loan company that can assist you with your financial needs, it's crucial to look for those that are accredited by the Better Business Bureau (BBB). The BBB is a non-profit organization that sets standards for business conduct and provides consumers with information about businesses' trustworthiness. Accreditation by the BBB signifies that a company adheres to high ethical standards and has demonstrated a commitment to customer satisfaction.

How to Find BBB Accredited Loan Companies

To find BBB accredited loan companies for bad credit, start by visiting the BBB's website. Here, you can search for accredited businesses in your area. The BBB provides detailed ratings and reviews for each business, allowing you to make an informed decision.

Another effective method is to use search engines with specific keywords, such as "BBB accredited loan companies for bad credit." This will help you narrow down your search results and find businesses that meet your criteria.

What to Look for in a BBB Accredited Loan Company

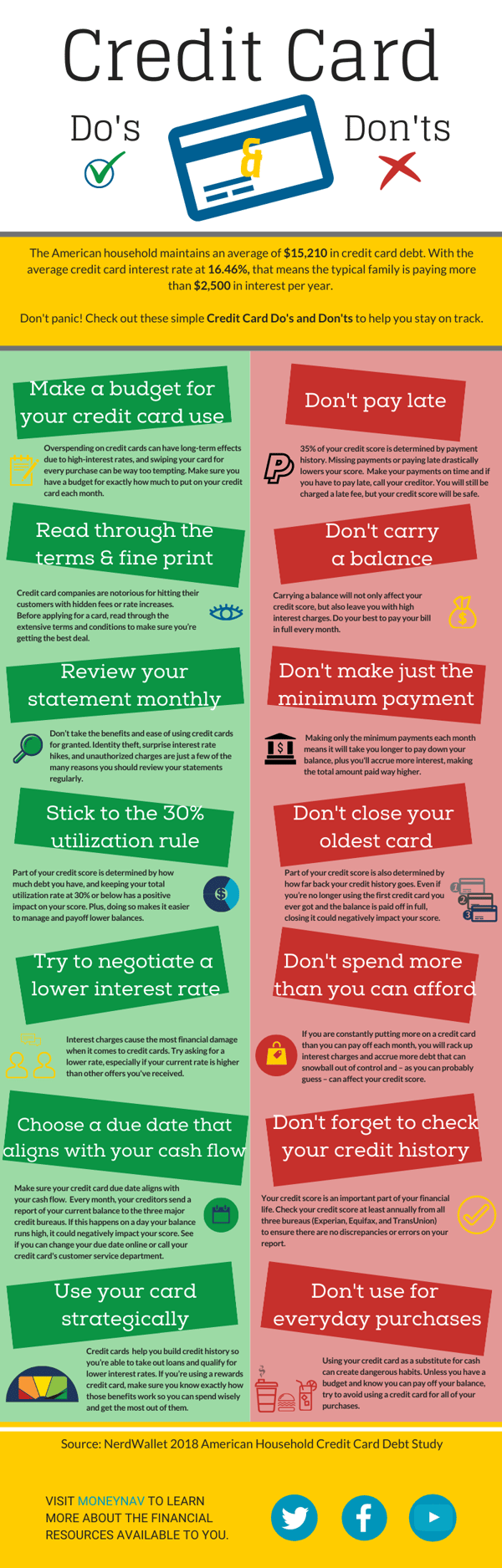

When evaluating BBB accredited loan companies for bad credit, there are several factors to consider. Firstly, look for a company that offers competitive interest rates and flexible repayment terms. These features can make a significant difference in your ability to manage your debt.

Secondly, consider the company's customer service. A reputable lender should be responsive to your inquiries and provide clear information about the loan application process. They should also be transparent about any fees or charges associated with the loan.

Lastly, review the company's BBB rating and customer reviews. A high rating and positive reviews from other customers can provide valuable insights into the company's reliability and trustworthiness.

Benefits of Working with BBB Accredited Loan Companies

One of the primary benefits of working with BBB accredited loan companies for bad credit is the peace of mind that comes with knowing you're dealing with a reputable lender. These companies are committed to providing fair and honest financial services, ensuring that you're not taken advantage of.

Another benefit is the streamlined loan application process. BBB accredited loan companies understand the unique challenges faced by individuals with bad credit and are often willing to work with you to find a solution that meets your needs.

Lastly, working with a BBB accredited loan company can help improve your credit score over time. By making timely payments and managing your debt responsibly, you can gradually improve your credit score and open up additional financial opportunities in the future.

In conclusion, finding BBB accredited loan companies for bad credit can be a game-changer for individuals struggling with financial difficulties. By adhering to high ethical standards and providing fair financial services, these lenders offer a lifeline to those in need. With a little research and due diligence, you can find a reputable lender that can help you get back on track financially.