Understanding the Student Loan On Ramp Period: What You Need to Know for Financial Success

#### What is the Student Loan On Ramp Period?The **student loan on ramp period** refers to a specific timeframe during which borrowers can transition into t……

#### What is the Student Loan On Ramp Period?

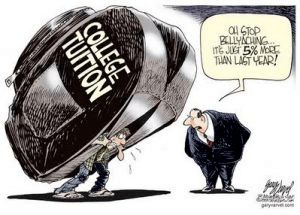

The **student loan on ramp period** refers to a specific timeframe during which borrowers can transition into their student loan repayment obligations. This period typically occurs after graduation, during which borrowers may have a grace period before they are required to start making payments on their loans. Understanding this phase is crucial for effective financial planning and management of student debt.

#### Importance of the Student Loan On Ramp Period

The **student loan on ramp period** is essential for several reasons. First, it allows graduates to secure employment and stabilize their financial situation before they begin repaying their loans. This period can vary depending on the type of loan and the lender, but it usually lasts between six months to one year. During this time, borrowers should take advantage of resources and tools available to them to prepare for repayment.

#### Preparing for Repayment During the On Ramp Period

During the **student loan on ramp period**, it is vital for borrowers to develop a repayment strategy. Here are some steps to consider:

1. **Understand Your Loans**: Borrowers should take the time to review their loan details, including interest rates, total amounts owed, and repayment terms. This knowledge will help in making informed decisions about repayment options.

2. **Create a Budget**: Developing a budget is crucial to managing finances effectively. Borrowers should assess their income, expenses, and savings goals to determine how much they can allocate towards loan payments once the ramp period concludes.

3. **Explore Repayment Options**: There are various repayment plans available, including standard, graduated, and income-driven repayment plans. Borrowers should research these options to find the one that best fits their financial situation.

4. **Consider Loan Forgiveness Programs**: Some borrowers may qualify for loan forgiveness programs, particularly those who work in public service or certain non-profit sectors. Understanding eligibility criteria during the on ramp period can help borrowers make strategic career decisions.

5. **Build an Emergency Fund**: Establishing an emergency fund can provide a financial cushion in case of unexpected expenses. This fund can be instrumental in ensuring that loan payments can be made consistently without financial strain.

#### Common Misconceptions About the Student Loan On Ramp Period

There are several misconceptions surrounding the **student loan on ramp period**. One common myth is that borrowers do not need to worry about their loans during this time. While it is true that payments may not be required, it is essential to use this period wisely to prepare for the financial responsibilities ahead.

Another misconception is that borrowers cannot make payments during the on ramp period. In reality, making early payments can reduce the total interest paid over the life of the loan and help borrowers pay off their debt faster.

#### Conclusion

The **student loan on ramp period** is a crucial time for recent graduates to prepare for their financial future. By understanding their loans, creating a budget, exploring repayment options, and debunking common myths, borrowers can set themselves up for success as they transition into repayment. Taking proactive steps during this period can lead to better financial health and reduced stress in the long run.