Unlock Your Financial Freedom with a $1000 Loan Direct Lender

Guide or Summary:$1000 Loan Direct LenderUnderstanding $1000 LoansBenefits of Choosing a Direct LenderEligibility RequirementsApplication ProcessConsiderati……

Guide or Summary:

- $1000 Loan Direct Lender

- Understanding $1000 Loans

- Benefits of Choosing a Direct Lender

- Eligibility Requirements

- Application Process

- Considerations Before Borrowing

$1000 Loan Direct Lender

In today's fast-paced world, financial emergencies can arise unexpectedly, leaving many individuals in need of quick cash solutions. A $1000 loan direct lender can be a lifeline for those facing urgent expenses, such as medical bills, car repairs, or unexpected household costs. This type of loan offers a straightforward approach to borrowing, allowing you to access funds without the hassle of dealing with intermediaries or lengthy approval processes.

Understanding $1000 Loans

A $1000 loan direct lender provides borrowers with a small, short-term loan typically designed to be repaid within a few weeks to a few months. These loans are often unsecured, meaning you don’t need to put up collateral like a house or car. This makes them an attractive option for those who may not have valuable assets to secure a traditional loan. However, it’s crucial to understand the terms and conditions associated with these loans, including interest rates and repayment schedules.

Benefits of Choosing a Direct Lender

One of the primary advantages of opting for a $1000 loan direct lender is the speed of the application process. Direct lenders often offer online applications that can be completed in minutes, with funds disbursed as quickly as the same day. This is particularly beneficial for individuals who need cash urgently. Additionally, working directly with a lender can lead to more personalized service and potentially better loan terms.

Eligibility Requirements

To qualify for a $1000 loan direct lender, borrowers typically need to meet certain criteria. While requirements may vary by lender, common factors include a steady source of income, a valid bank account, and being at least 18 years old. Some lenders may also conduct a credit check, but many direct lenders are willing to work with individuals who have less-than-perfect credit.

Application Process

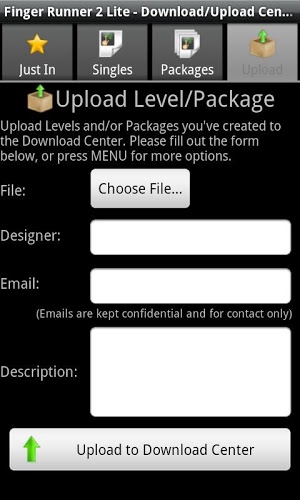

Applying for a $1000 loan direct lender is usually a straightforward process. Most lenders require basic personal information, proof of income, and bank account details. Once you submit your application, the lender will review your information and make a decision. If approved, you can expect to receive the funds in your bank account within a short period, allowing you to address your financial needs promptly.

Considerations Before Borrowing

While a $1000 loan direct lender can provide quick access to cash, it’s essential to consider the potential downsides. These loans often come with higher interest rates compared to traditional loans, which can lead to significant repayment amounts if not managed carefully. Borrowers should ensure they have a clear repayment plan in place to avoid falling into a cycle of debt.

In conclusion, a $1000 loan direct lender can be a valuable option for individuals in need of quick financial assistance. By understanding the benefits, eligibility requirements, and potential pitfalls, borrowers can make informed decisions that align with their financial situations. Always remember to read the fine print and choose a reputable lender to ensure a positive borrowing experience. With the right approach, a $1000 loan can help you navigate through financial challenges and regain your peace of mind.